√100以上 1095-c examples 2021 299411

What Payroll Information Prints On Form 1095 C To Employees

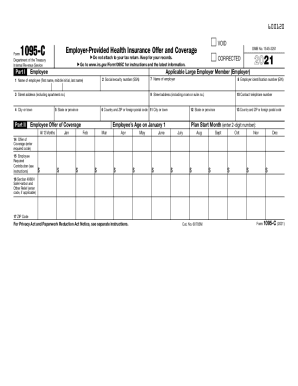

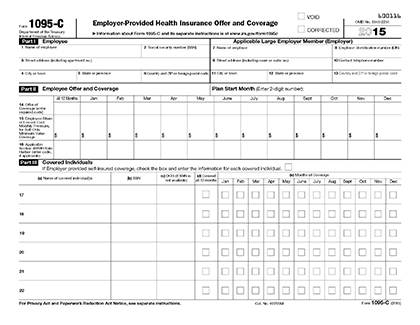

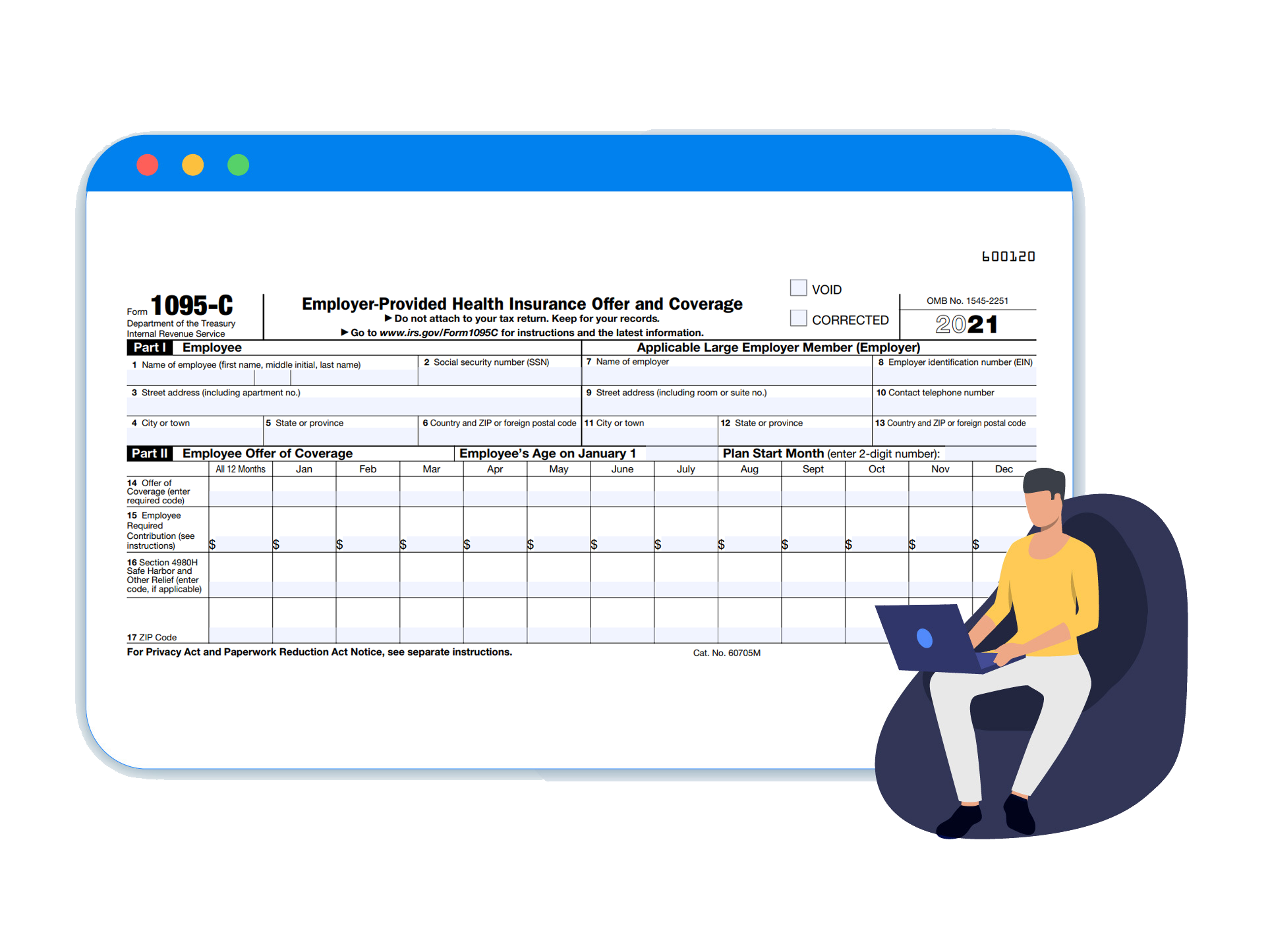

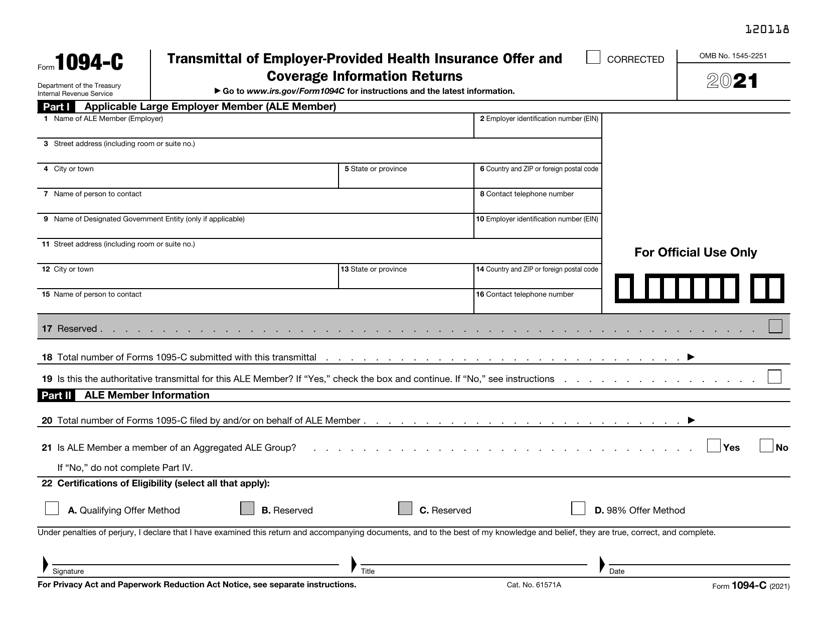

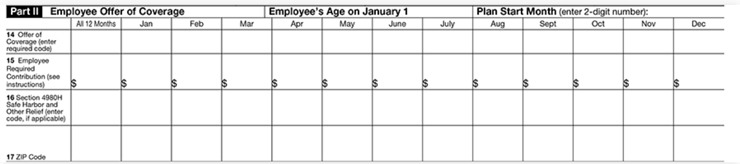

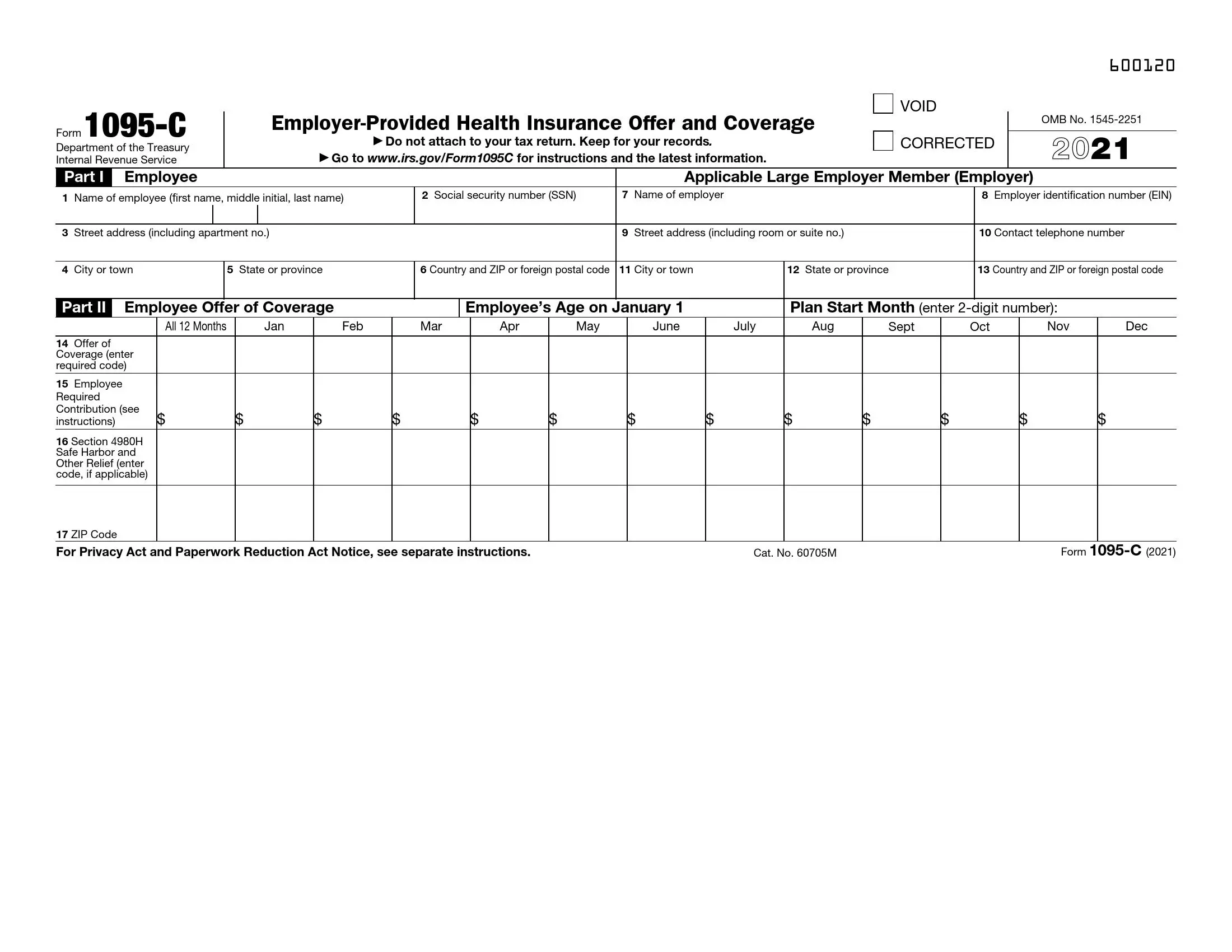

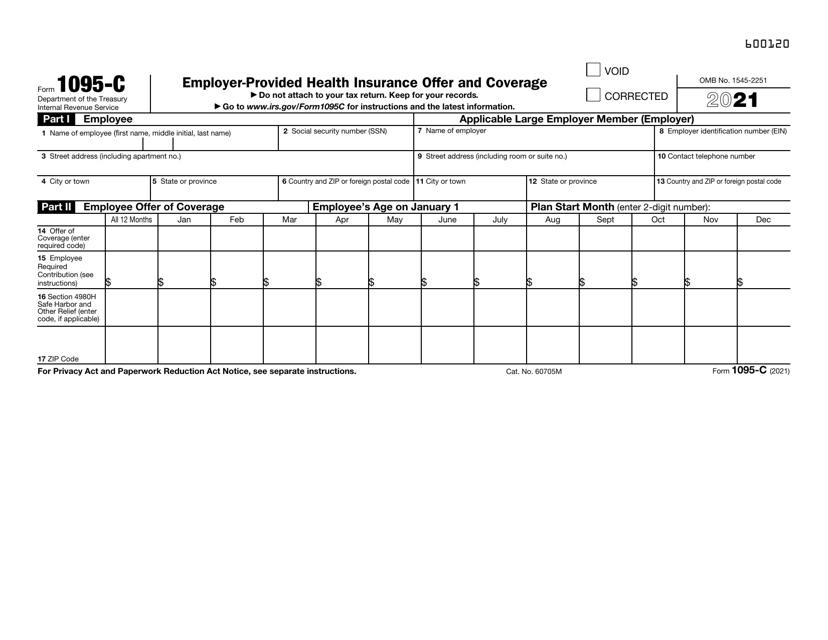

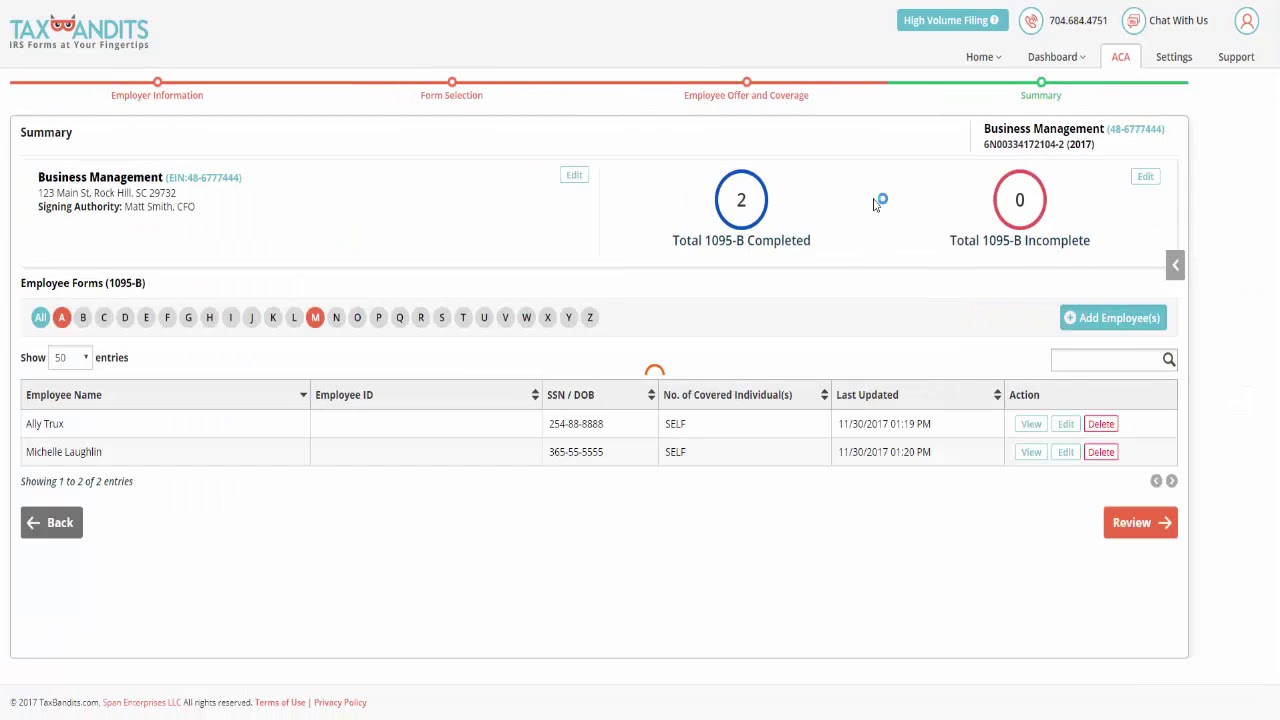

If you need assistance completing your 1095C forms for the 21 tax year, download the Employer's Guide to Coding ACA Form 1095C below This resource provides concrete examples of how to code unique healthcare situations, including HRAs, as well as a glossary of all the different code options available Understanding Form 1095C Codes for Line 14 and Line 16 Updated on 1030 am by, TaxBandits Employers might feel overwhelmed in terms of understanding and completing lines 1416 of Form 1095C codes If you report the incorrect codes on Form 1095C, it leads employers to pay huge penalties

1095-c examples 2021

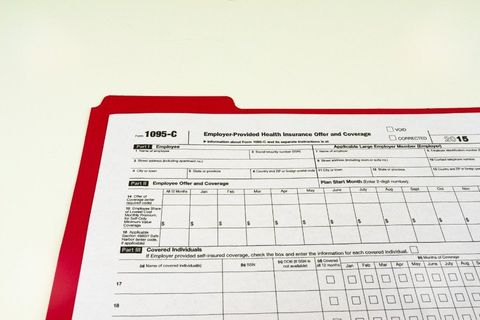

1095-c examples 2021-Form 1095C must be provided to the employee and any individual receiving MEC through an employer by January 31 of the year following the calendar year to which the return relates Extensions – No penalty will be imposed for federal Forms 1094C and 1095C filed with the FTB on or before May 31 Page 2 FTB Pub 35C 21FullTime Employee Hired Midyear;

Common 1095 C Scenarios

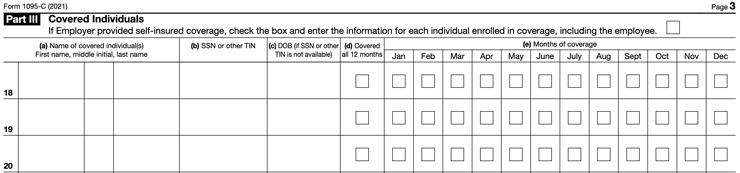

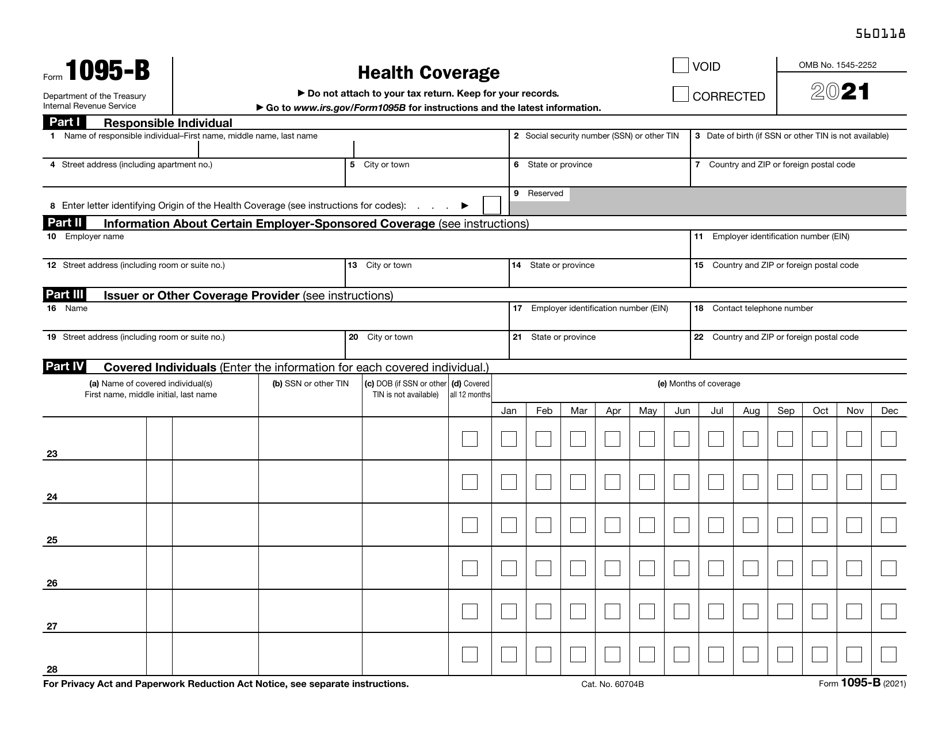

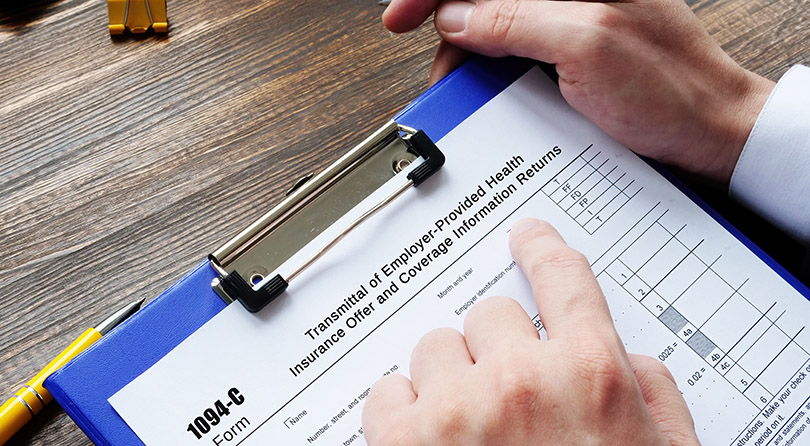

The 1095cs have been generated in pdf format and can be printed on blank paper, as you can see You can see that we've masked thessns and other words as we scroll down the list The Employees' 1095c Instructions are also included We have all of our 1095cs in this example a single pdf file As you can see, the 1095cs are generated andInst 1094C and 1095C Instructions for Forms 1094C and 1095C 21 Form 1095A Health Insurance Marketplace Statement 21 Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement 21 Form 1095BALEs use the 1095C for most reporting purposes, so this guide will focus on the 1095 C requirements ALEs who offer selffunded coverage to nonemployees (who choose to use the 1095B) and small employers with selffunded plans should refer to IRS 1095B instructions

IRS Adds Two New Codes on ACA Form 1095C At the end of October 21, the IRS released a new Form 1095C, which adds two new 1095C codes 1T and 1U for employers to meet the ICHRA reporting requirements An ICHRA is an employersponsored reimbursement plan that allows employees to purchase their health insurance plan privately or on the open marketFAQs for Employees Receiving 1095C Forms 1 Why am I getting this 1095C Form?Form 1095C (21) 6002 / 6004 Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer

1095-c examples 2021のギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

| ||

|  | |

|  | |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

| /ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png) | |

|  | |

|  |  |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  |  |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | /ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) |

| :max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png) |  |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) |  |  |

|  |  |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

| ||

|  |  |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  |  |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |  |

|  |  |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  |  |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

| :max_bytes(150000):strip_icc()/imageedit_4_7778438120-f5a8a7aac0fd466ab91af5b4d29ebf6e.jpg) |  |

.png) |  | |

|  |  |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |  |

|  | |

「1095-c examples 2021」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |

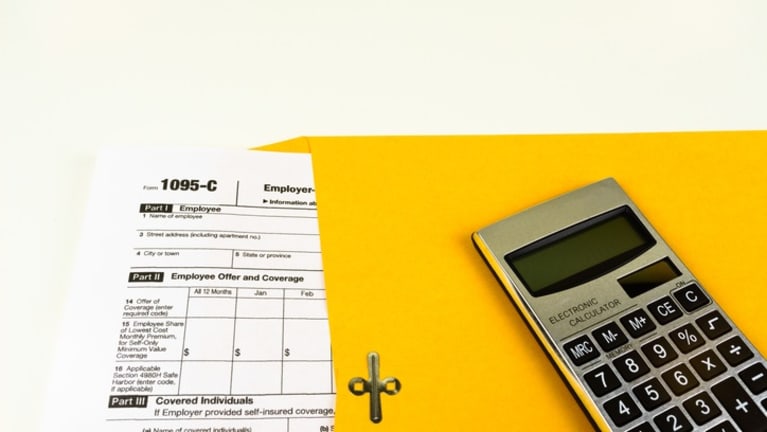

Form 1095C () Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Instructions for Completing Form 1095C HR leaders must submit a 1095C Form for every FTE The following instructions and tips will help you complete the filing process The IRS defines FTE as anyone who works more than 30 hours per week or 130 hours per month Part I Employee & ALE Member

コメント

コメントを投稿